Installed capacity power generation in China

The Chinese power industry has been in the focus of both domestic and international discussions ever since the reform and opening of the People’s Republic in the late 1970s. Seen as the engine room of industrial momentum by the Chinese government, the expansion of the pre-existing generation system using cheap and available resources was prioritized. Until the early 2000s, Chinese infrastructure struggled with imbalances in the electricity system, with wide parts of the country suffering from frequent local black-outs. In order to even out load peaks and valleys in the supply of electricity, the highly fragmented grid system had to be developed as well. Meanwhile, the import volume of energy has skyrocketed since the beginning of 2000s.

Since 2005, the Chinese government has intensified its efforts to privatize parts of the sector. Whereas the transmission and distribution of electricity remained under state control, the power generation market was partly opened to private and foreign investors. The main reasons for this change in direction were to be seen in the need to operate the system more cost-effectively and to attract clean technologies for power generation. Some major grid operators now include the former monopoly State Grid Corporation, and China Southern Power Grid.

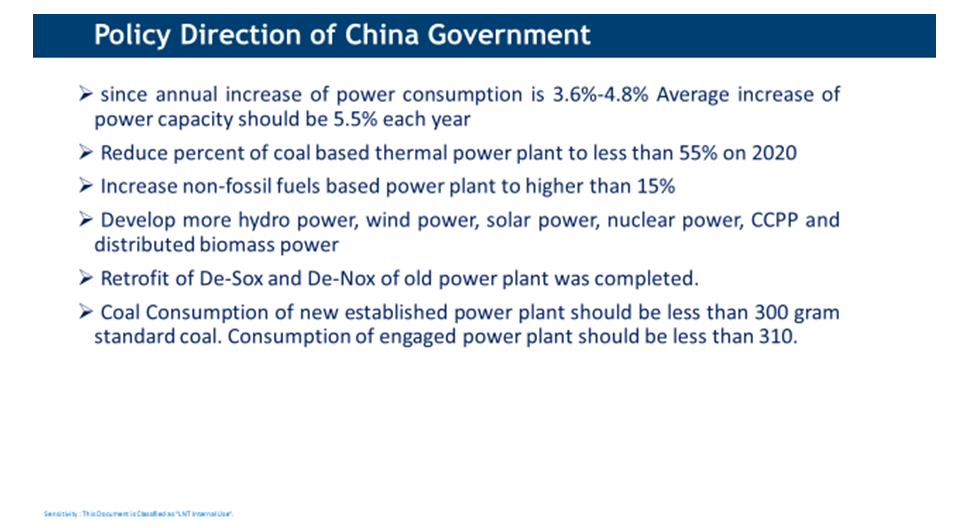

Majority of energy was produced from fossil fuels in China. International criticism regarding China’s energy mix, with its heavy reliance on coal as main source for electricity generation, was joined by rising concerns of the populace over heavy carbon dioxide and particle pollution measures. In recent years, renewable energy sources such as wind, biomass and solar power capacities have been developed at an incredible pace. Consumption of renewables in China ranged at almost 144 million tons of oil equivalent by the end of 2018. In the thirteenth five-year plan, China planned to reach a total of 676 GW of green power capacity, among which half was accounted by hydropower.

Despite the effort of increasing share of renewable energy, power generation from fossil fuel in China still multifolded itself in the last 20 years in order to reach the constantly increasing energy demand. The energy demand in China was forecasted to peak around 2030 and would start decreasing from technological advancement in the following decades. Regarding the installed capacity for power generation, it was forecasted to grow six times of the size now in the next three decades, while vast majority of that would be sourced from green energy by then.

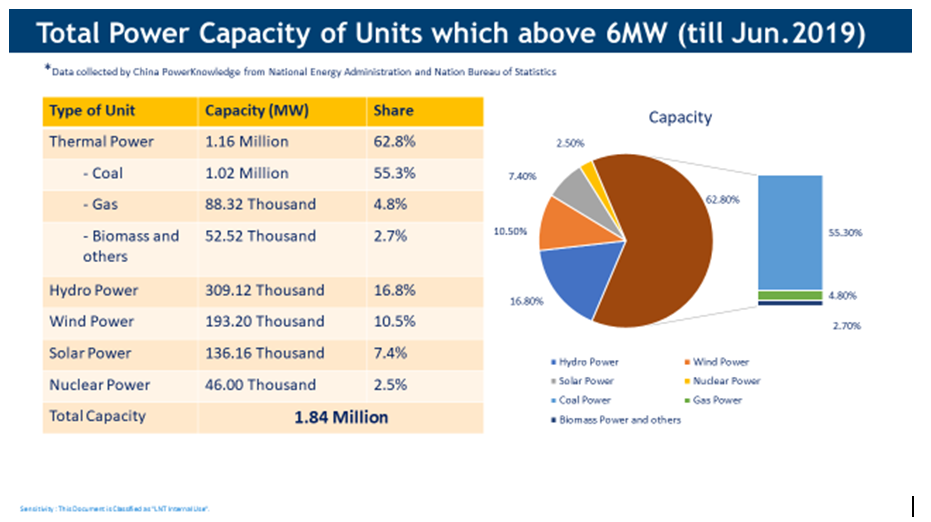

As of 2019, approximately 2,000 GW of electric power generation capacity had been installed in China. Energy discrepancy in China China is known to be the most populated country in the world. Population growth coupled with steady economic growth in the past has created a huge burden on energy requirements in the country. In less than two decades, the energy consumption of China has tripled from less than one million tons oil equivalent to over 3.2 billion tons in 2018. Meanwhile, 3.8 billion tonsof standard coal equivalent. Therefore, the import volume of energy in China has been rapidly growing since 2005, while the export volume of energy has stayed at the same level. Renewable energy in China In order to cope with the growing energy demand, China has been increasing its capacity and overall generation volume of electricity from a diverse range of energy sources. Although most of this growth came from thermal power, which has been the main source of energy in China for a long time, Chinese consumption of renewable energy in 2018 surged to over 140 times the consumption rate of the early

China Boiler Industry

Installed Thermal Power Capacity in China was About 1.14 Billion Kilowatts in 2018, Accounting for 60% of the Total Installed Capacity of Electricity in China.

Boilers play an important role in China’s economy and the Chinese people’s lives. The boiler is one of the major equipment of thermal power generation. By the end of 2018, the installed thermal power capacity in China was about 1.14 billion kilowatts, accounting for 60% of the total installed capacity of electricity in China, and it is still rising.

By the end of 2018, there were more than 500 boiler manufacturers in China, and the average annual production volume was less than 1,000 evaporation tons. China’s boiler industry is troubled by low market concentration ratio, outdated technologies and low gross profit margins.

China-made boilers are dominated by industrial boilers. In industrial production, industrial boilers are essential thermal power equipment. They are classified into coal-fired steam boilers, oil and gas fired steam boilers, thermal oil furnaces, hot-blast stoves and applied in power generation, industrial production, light industry, textiles, metallurgy, etc.

As coal-fired boilers cost much less than natural gas boilers, they dominate China’s industrial boiler market. For a long time to come, they will continue to be the mainstream of industrial boilers in China, and most of them will be medium and heavy-duty ones. Coal-fired boilers cause serious environmental pollution. As the energy supply structure changes and energy conservation and environmental protection requirements become more stringent, small coal-fired industrial boilers will be phased out, and the energy-efficient and low-pollution industrial boilers that use clean fuels and clean combustion technologies will become a development trend.

As China’s environmental protection policies have become stricter in recent years, the Chinese government is promoting the transformation and upgrade of industrial boiler manufacturers. In Jul. 2016, China’s Ministry of Industry and Information Technology issued the Plan for Industrial Application of Energy Efficient and Environmentally Friendly Industrial Boilers to transform and upgrade the industrial boiler industry, save energy, reduce emissions and improving the environment. The Plan requires that by the end of 2020, some production bases of energy efficient and environmentally friendly industrial boilers should have been built, and energy efficient and environmentally friendly industrial boilers should take up a market share of more than 60% with a production volume of 1 million evaporation tons.

Many local governments of China have also taken measures to control the pollutant discharge of industrial enterprises. Replacing coal-fired boilers with natural gas boilers or electric boilers has become a hot trend. In cities that have the pipelines for the West-East Gas Transmission Project and natural gas import and port cities that are able to import liquefied gas and their surrounding areas, gas-fired boilers have huge growth potential. Supported and encouraged by the Chinese government, the gas-fired boiler industry has a bright prospect.

To meet the standards of energy conservation and environmental protection, many industrial boiler manufacturers are upgrading their boilers. Supported and encouraged by the Chinese government, the gas-fired boiler industry will have a bright prospect. Environmentally friendly gas-fired boilers will certainly replace coal-fired boilers to become the mainstream products on China’s boiler market.

Forecast to 2024 of China’s Boiler Industry

By the end of 2018, the installed thermal power capacity in China was about 1.14 billion kilowatts, accounting for 60% of the total installed capacity of electricity in China, and it is still rising.

By the end of 2018, there were more than 500 boiler manufacturers in China, and the average annual production volume was less than 1,000 evaporation tons. China’s boiler industry is troubled by low market concentration ratio, outdated technologies and low gross profit margins.

China-made boilers are dominated by industrial boilers. In industrial production, industrial boilers are essential thermal power equipment. They are classified into coal-fired steam boilers, oil and gas fired steam boilers, thermal oil furnaces, hot-blast stoves and applied in power generation, industrial production, light industry, textiles, metallurgy, etc.

As coal-fired boilers cost much less than natural gas boilers, they dominate China’s industrial boiler market. For a long time to come, they will continue to be the mainstream of industrial boilers in China, and most of them will be medium and heavy-duty ones. Coal-fired boilers cause serious environmental pollution. As the energy supply structure changes and energy conservation and environmental protection requirements become more stringent, small coal-fired industrial boilers will be phased out, and the energy-efficient and low-pollution industrial boilers that use clean fuels and clean combustion technologies will become a development trend.

As China’s environmental protection policies have become stricter in recent years, the Chinese government is promoting the transformation and upgrade of industrial boiler manufacturers. In Jul. 2016, China’s Ministry of Industry and Information Technology issued the Plan for Industrial Application of Energy Efficient and Environmentally Friendly Industrial Boilers to transform and upgrade the industrial boiler industry, save energy, reduce emissions and improving the environment. The Plan requires that by the end of 2020, some production bases of energy efficient and environmentally friendly industrial boilers should have been built, and energy efficient and environmentally friendly industrial boilers should take up a market share of more than 60% with a production volume of 1 million evaporation tons.

Many local governments of China have also taken measures to control the pollutant discharge of industrial enterprises. Replacing coal-fired boilers with natural gas boilers or electric boilers has become a hot trend. In cities that have the pipelines for the West-East Gas Transmission Project and natural gas import and port cities that are able to import liquefied gas and their surrounding areas, gas-fired boilers have huge growth potential. Supported and encouraged by the Chinese government, the gas-fired boiler industry has a bright prospect.

To meet the standards of energy conservation and environmental protection, many industrial boiler manufacturers are upgrading their boilers. Supported and encouraged by the Chinese government, the gas-fired boiler industry will have a bright prospect. Environmentally friendly gas-fired boilers will certainly replace coal-fired boilers to become the mainstream products on China’s boiler market.

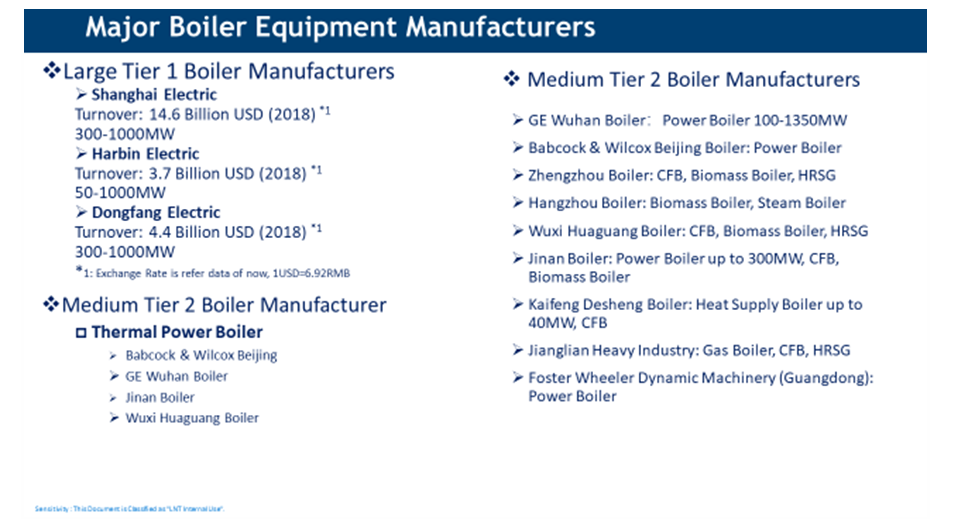

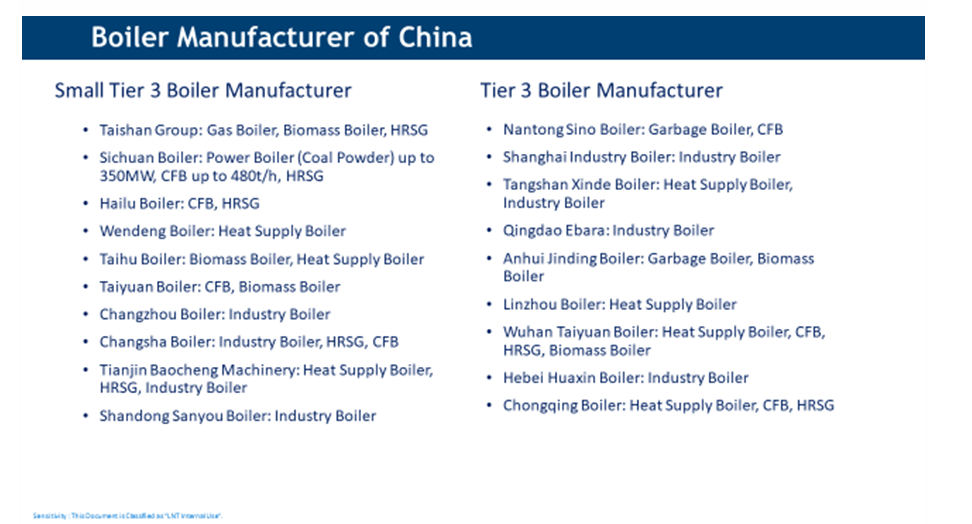

Major Boiler Manufacturers in China, 2018-2019

- Dongfang Boiler Group Co. Ltd.

- Harbin Boiler Company Limited

- Shanghai Boiler Works Co. Ltd.

- Hangzhou Boiler Group Co. Ltd.

- Taishan Group Co. Ltd.

- Wuxi Huaguang Boiler Co. Ltd.

- China Western Power Industrial Co. Ltd.

- Jinan Boiler Group Co. Ltd.

- Suzhou Hailu Heavy Industry Co. Ltd.

- Anhui Jinding Boiler Co. Ltd.

- Wuhan Boiler Company Limited

- Babcock & Wilcox Beijing Co. Ltd.

- Zhengzhou Boiler Co. Ltd.

Is China investing in nuclear power?

Apart from renewable energy sources, China has put a focus on the development of nuclear power over the past years. The investment structure of the electricity sector in China suggests a shift of investments from thermal power towards nuclear and hydropower projects by the end of 2018.

New developments

- S-CO2

Supercritical Carbon Dioxide Boiler is a developing new technology in past more than ten years. US, UK, France, Japan and South Korea are all in research of use supercritical CO2 fluid to replace supercritical steam in working medium of power generation system.

China start basic theory research of supercritical CO2 in 2012 and list it in critical equipment development of Made in China 2025.

Harbin Boiler, be leader of one research team, which include China Special Equipment Inspection & Research Institute (CSEI), Harbin Institute of Technology (HIT), Xi’an Thermal Power Research Institute and North China Electric Power University to undertake one National Key Research and Development Project for supercritical carbon dioxide quality evaluation technical system.

This is first time thermal power equipment manufacturer lead one National Key Research and Development Project. Supercritical carbon dioxide boiler technology be expected a most important research way of thermal power industry recently.

Efficiency of power generation will be increased 3-5% by replace supercritical steam in circulation to supercritical carbon dioxide fluid.

And it was found if other condition fixed, supercritical CO2 system can take same efficiency at 600 degree which supercritical steam system can take at 700 degree.

At same time, CO2 can become supercritical condition in lower pressure and temperature, and corrosiveness is lower than water.

2. Carbon Emission trading of power plant started on 1st Jan 2021

Annual carbon emission of Chinese power industry is above 3 billion ton, account 1 of 3 of China total carbon emission.

Ministry of Ecological Environment of China publish carbon emission trading will contain all 2225 enterprise in power generation industry in China, each plant will get emission quota based on type of fuel and technology of power generation, and quota will be reduced in future which will increase cost of traditional fuel power and reduce cost of renewable energy power. As expectation, cost of each kilowatt hour for solar power will be reduced 7%.

Policy of power industry support will favour to renewable energy power generation steadily

3. Capacity of Power Generation

New installed capacity of power generation is 190 thousand MW, inside it:

Hydropower, 13.24 thousand MW

Wind power, 71.67 thousand MW

Solar power, 48.2 thousand MW

Clean power generation (hydro, wind, solar, nuclear, biomass, LNG) occupy 71% new installed capacity.

Total installed capacity till 2020 is 2.2 million MW

Thermal power capacity is 1.245 million MW

Coal based installed capacity till 2020 is 1.095 million MW, less than 50% of total

Ultra-low emission coal based thermal power capacity 890 thousand MW.

Shri Deepak Shinde, Head –SCM (China/Korea) L&T, Energy-Power & LTHE IC

D K Shrivastava

March 12, 2021 at 3:47 amWell captured and very useful information about China’s trend and policies…